A homeowner is “short” when they owe an amount on the property that, when combined with closing costs and commissions, is higher than the current market value. A short sale occurs when a negotiation is entered with the homeowner’s mortgage company or companies to accept less than the full balance of the loan at closing. A buyer closes on the property and the property is sold “short”.

A short sale allows the homeowner to avoid foreclosure, minimize financial damage and move on from a burdensome, unaffordable mortgage. In many cases, a short sale allows the borrower to qualify for a new mortgage in just 24 months, as opposed to five years or more after a foreclosure.

A trained real estate agent can negotiate a short sale with a lender if the seller has 3 qualifications. First, they must show some type of financial hardship. Second, they must have a monthly shortfall, meaning their monthly expenses are greater than their monthly income. Finally, they need to prove that their debts are greater than the value of their assets (certain investments, property, etc.).

How Can You Help Keep the Short Sale Process Running Smoothly?

- Complete all necessary forms in a timely manner

- Gather and provide all necessary documentation as needed

- Keep property presentable and ready to sell

- Be available to communicate with the mortgage company if necessary

Questions?

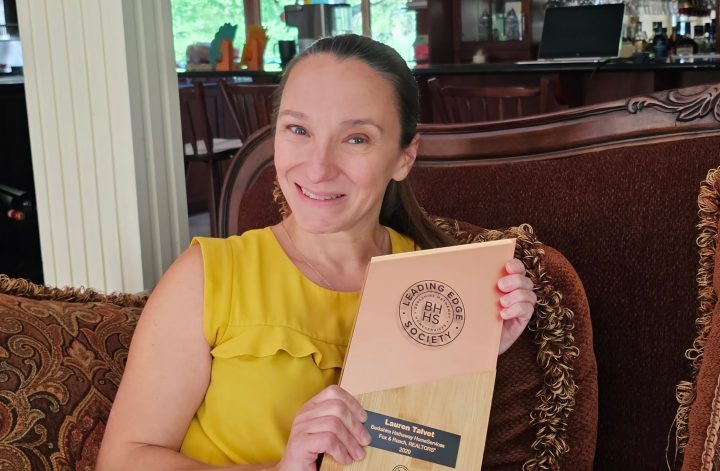

If you or someone you know can use my services, call or email me today so we can get started!

2 Comments